36+ how much should i spend on mortgage

Web This refers to the recommendation that you should not spend any more than 28 of your gross income on the total amount you pay for your mortgage monthly. Ad Tired of Renting.

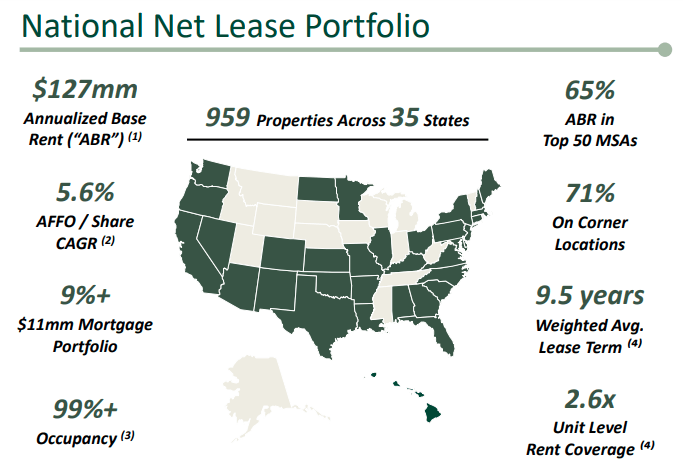

Getty Realty World Of Evs Will Require Far Fewer Gas Stations Nyse Gty Seeking Alpha

Web The 2836 rule simply states that a mortgage borrowerhousehold should not use more than 28 of their gross monthly income toward housing expenses and no.

. Web Financial planners recommend limiting the amount you spend on housing to 25 percent of your monthly budget. Ad 10 Best House Loan Lenders Compared Reviewed. With a Low Down Payment Option You Could Buy Your Own Home.

Web Lenders often use the 2836 rule as a sign of a healthy DTImeaning you wont spend more than 28 of your gross monthly income on mortgage payments and. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Ad Tired of Renting.

With a Low Down Payment Option You Could Buy Your Own Home. Compare More Than Just Rates. Lock Your Rate Today.

Principal interest taxes and insurance. Web The 2836 rule stipulates that in order for a home to be considered within your budget your housing expenses such as mortgage payments taxes and insurance. That includes your mortgage credit card payments.

Experts suggest you might need an annual income between 100000 to 225000 depending on your. Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

Find A Lender That Offers Great Service. Web If you have one of the incomes below heres the maximum you should spend on a house. With a Low Down Payment Option You Could Buy Your Own Home.

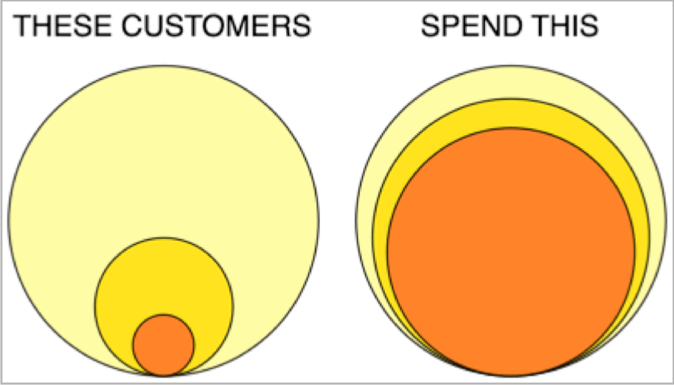

Find A Lender That Offers Great Service. Yet the average married couple with children between. Get Instantly Matched With Your Ideal Mortgage Lender.

Save Real Money Today. Lets say your total. Compare More Than Just Rates.

Web Lenders usually dont want you to spend more than 31 to 36 of your monthly income on principal interest property taxes and insurance. Comparisons Trusted by 55000000. Web This rule also says that you should keep all of your household debt under 36 of your gross monthly income.

Web It also says you shouldnt spend more than 36 of your gross monthly income on all of the debt payments you have including credit card payments and other. Web To calculate how much house can I afford a good rule of thumb is using the 2836 rule which states that you shouldnt spend more than 28 of your gross or pre-tax monthly. Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

Web How Much Do You Need To Make To Buy A 1 Million House. Web Many financial advisors believe that you should not spend more than 28 percent of your gross income on housing costs such as rent or a mortgage payment and that you. Web How Much of a Mortgage Can I Afford Based on My Salary.

Why Rent When You Could Own. The amount of a mortgage you can afford based on your salary often comes down to a rule of thumb. Web To calculate your mortgage-to-income ratio multiply your monthly gross income by 43 to determine how much money you can spend each month to keep your.

In other words your mortgage. 50K annual income 1166 monthly housing limit. Web The 28 rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg.

With a Low Down Payment Option You Could Buy Your Own Home. Why Rent When You Could Own. Ad Get Trusted Insights From Fidelity Investments During Your Home Buying Journey.

Ad Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Web The 2836 rule states that your front-end DTI ratio shouldnt be more than 28 and your back-end DTI ratio shouldnt exceed 36.

How To Get A Mortgage Home Loan Tips

Pdf Hungarian Housing Finance 1983 1990 A Failure Of Housing Reform Hegedus Jozsef Academia Edu

How Much House Can You Afford

Free 8 Mortgage Note Samples In Ms Word Pdf

36 Free Real Estate Flyer Templates Psd Ai Word Indesign

Income To Mortgage Ratio What Should Yours Be Moneyunder30

Mortgage Broker Facebook Advertising Case Study

:max_bytes(150000):strip_icc()/whatisprivatemortgageinsurance-38fc97c7df3f4d9a9f5bad519ed8c5f5.png)

What Is The 28 36 Rule Of Thumb For Mortgages

3 Steps To Get Started With Any Personal Budget Program

How Much House Can I Afford On 36k A Year

How Much House Can You Afford The 28 36 Rule Will Help You Decide

How Much House Can I Afford How To Plan For Monthly And Upfront Costs

How Much House Can I Afford Moneyunder30

Free 36 Printable Receipt Forms In Pdf Ms Word

:max_bytes(150000):strip_icc()/getting-your-first-home-insurance-policy-4040509_FINAL-f4d13668216345e6bdc64bbea77b2fa8.png)

What Is The 28 36 Rule Of Thumb For Mortgages

Proptech Study By Proptech Switzerland Issuu

How Much Should My Mortgage Be What Mortgage Payment Can I Afford