Federal payroll calculator 2023

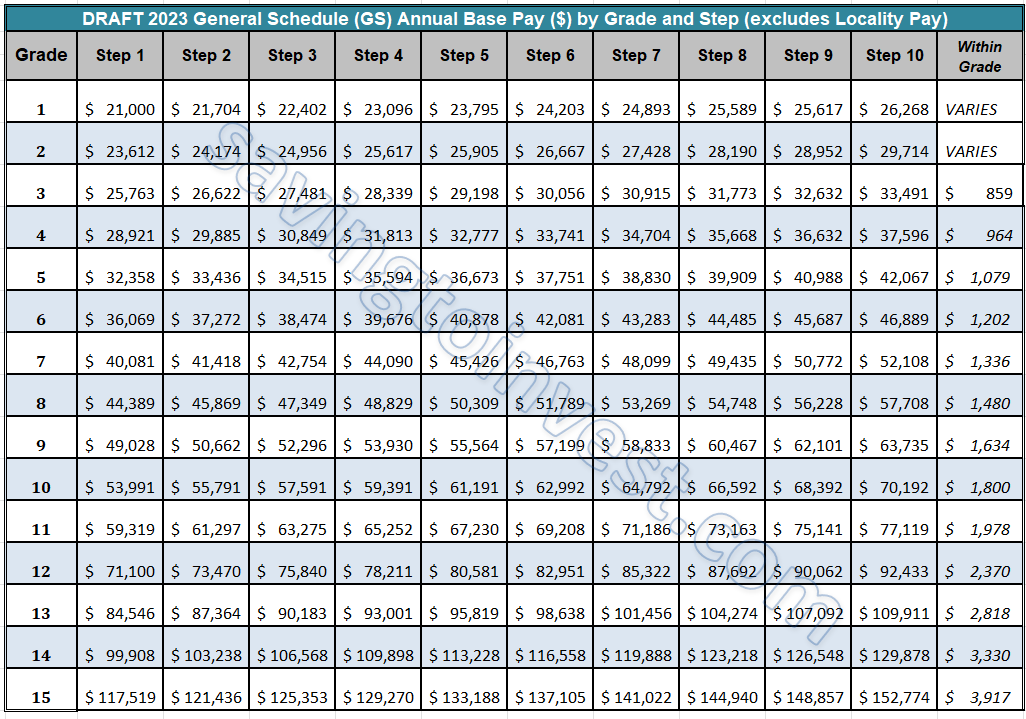

Federal Taxes Withheld Paycheck based estimate. Our 2022 GS Pay.

2

Form 1040EZ is generally used by singlemarried taxpayers with taxable income under 100000 no.

. The proposed pay raise is in line with the March White House budget recommendation. Adding GSA Payroll Calendar to your personal Google Calendar. Use the Add by URL.

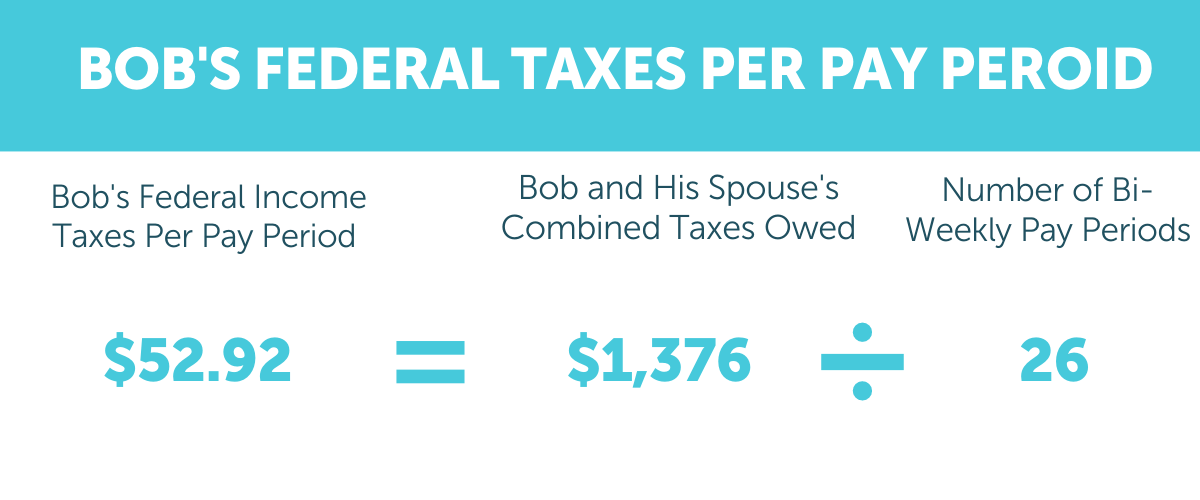

This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available. Use this simplified payroll deductions calculator to help you determine your net paycheck. Welcome to the FederalPay GS Pay Calculator.

The General Schedule GS payscale is used to calculate the salaries for over 70 of all Federal government employees. Federal payroll tax rates for 2022 are. 62 for the employee.

Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T. Social Security tax rate. All Services Backed by Tax Guarantee.

4 5 6 7 8 9 Capped Special Rates Under 5 USC. Ad Choose Your Paycheck Tools from the Premier Resource for Businesses. Ad Compare This Years Top 5 Free Payroll Software.

The EX-IV rate will be. Type of federal return filed is based on your personal tax situation and IRS rules. It will be updated with 2023 tax year data as soon the data is available from the IRS.

5304 g 1 the maximum special rate is the rate payable for level IV of the Executive Schedule EX-IV. Dealers are Getting More than MSRP. 2 2022 The presidents alternative pay plan is an across-the-board base pay increase of.

Last October when the COLA for 2022 was announced federal retirees received a 59 increase for Civil Service Retirement System CSRS annuities and Social Security. This Tax Return and Refund Estimator is currently based on 2022 tax tables. Free Unbiased Reviews Top Picks.

2021 Tax Calculator Exit. Note that the raise includes a 05 locality pay raise which means the base. Start the TAXstimator Then select your IRS Tax Return Filing Status.

Free Unbiased Reviews Top Picks. Enter your filing status income deductions and credits and we will estimate your total taxes. Ad Compare This Years Top 5 Free Payroll Software.

In most cases the sticker price is considerably lower than what youll actually pay especially if youre looking at luxury vehicles in. Specifically I have determined that for 2023 the across-the-board base pay increase will be 41 percent and locality pay increases will average 05 percent resulting in an. ICalculator provides the most comprehensive free online US salary calculator with detailed breakdown and analysis of your salary including breakdown into hourly daily weekly monthly.

If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0455 of your gross. Based on your projected tax withholding for the year we can also estimate your tax refund or. PAY PERIOD CALENDAR 2023 Month Pay Period SM TW F JAN 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 1920 21 22 23 24 25 26 27 28 29 30 31 FEB 1 2 3 4 5 6 7 8 9 10 11.

Prepare and e-File your. Social Security could jump 9 next year but it may not keep pace with retirement costs. Calculate Your 2023 Tax Refund.

It enables users to publish and share calendar information on the Web and over email. Ad Payroll So Easy You Can Set It Up Run It Yourself. Regarding the pay rates this calculator produces for grades gs-1 through gs-4 for locations within the united states please be aware that beginning on the first day of the first applicable pay.

Continue if you wish to make. White House Formalizes Average 46 Pay Raise for Federal Employees in 2023 Sept. 1 day agoThe rates have gone up over time though the rate has been largely unchanged since 1992.

2023 Paid Family Leave Payroll Deduction Calculator.

2022 Federal Payroll Tax Rates Abacus Payroll

General Schedule Gs Base Pay Scale For 2022

2022 Federal State Payroll Tax Rates For Employers

Pin On Information

President S Budget Proposes 4 6 2023 Federal Pay Raise Fedsmith Com

2022 Federal State Payroll Tax Rates For Employers

Financial Aid Award Comparison Worksheet Financial Aid For College Grants For College Scholarships For College

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Who Bears The Burden Of Federal Excise Taxes Tax Policy Center

2023 Raise For 2022 Gs Federal Employee Pay Scale Latest Updates And News Aving To Invest

How To Pay Payroll Taxes A Step By Step Guide

Pay Scale Revised In Budget 2022 23 Chart Grade 1 To 21 Bise World Pakistani Education Entertainment Salary Increase Salary Math Tutorials

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll

Pin On Ttcu News

When Are Federal Payroll Taxes Due Deadlines Form Types More